More than half of tropical deforestation linked to exports of key commodities is happening in less than 5% of producing regions

Also in:

Português brasileiroData on the sustainability of global trade reveals the commodities, regions and supply chains with the largest deforestation impacts, showing where efforts should be targeted to drive down deforestation linked to the production of commodities such as beef, soy and palm oil.

Oxford, United Kingdom, and Stockholm, Sweden (2 July 2020) — A new assessment of the sustainability of global trade in agricultural commodities, the Trase Yearbook 2020, identifies the handful of hotspots, commodities and companies that are behind the majority of tropical deforestation linked to this trade.

Toby Gardner, director of Trase, a joint initiative of the Stockholm Environment Institute and Global Canopy, and one of the lead editors of the report said, “Our data pinpoints deforestation hotspots linked to top exports and markets and show time and time again that most of the problem is concentrated in a handful of suppliers, and a handful of places. These insights are incredibly powerful as they provide entry points for action—by companies, governments and investors—that can catalyze and direct enforcement, investment and engagement to where it is needed the most.”

Using unique supply chain data that links commodity production, specific trading companies and consumer markets, the Trase Yearbook 2020 shows how between 50% and 70% of all exports of soy, beef and palm oil produced in Brazil, Paraguay, Argentina and Indonesia is handled by the top five exporters for each commodity.

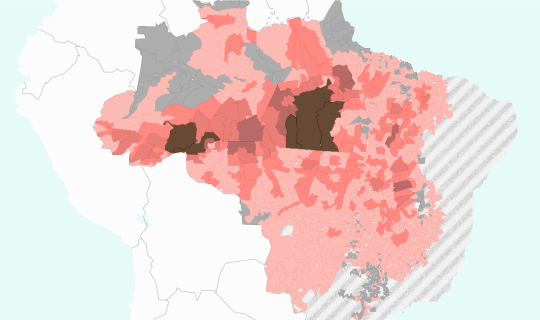

Critically, for the first time, the data also reveals how more than half the deforestation linked to these three traded agricultural commodities occurs in 5% or less of the total area where the commodities are produced. Exports from these deforestation hotspots are destined for specific markets in Europe, but increasingly in China and emerging economies.

The hotspots identified by Trase are often in places that have attracted little international attention, such as the Brazilian Cerrado and the Gran Chaco dry forests of Latin America.

While the largest buyers and markets for commodities such as soy and beef are typically linked to the greatest impacts, buyers that source disproportionately from these hotspots have carbon footprints that can be up to 10 times that of the average buyer.

The Yearbook reveals that, while the EU imports less soy than China, and has stronger deforestation commitments, over the last decade its imports are linked to more deforestation per ton. This is because it sources greater volumes from deforestation hotspots. For example, the carbon footprint of soy imports to Spain—Europe’s largest consumer of the commodity—is, on a per-ton basis, six times larger than that of China, the largest buyer of soy, beef and palm oil produced in the tropics globally.

The report draws particular attention to the sustainability concerns linked to the production and trade of beef, for which global demand is soaring. The report estimates that in 2018 the expansion of pastures for beef production was responsible for 81% of deforestation in the Brazilian Amazon, 95% of deforestation in the Paraguayan Chaco and over 54% in the Cerrado. However, once again the report reveals how these impacts are often highly concentrated, showing that:

- Just 3% of the 2,803 beef-producing municipalities in Brazil are associated with over half the deforestation linked to beef exports.

- Beef exports from Paraguay are linked to more than nine times the deforestation than exports from the Brazilian Amazon.

- Live cattle exports, mainly for halal markets in the Middle East, are associated with nearly five times the deforestation linked to fresh meat exports.

- Brazilian beef exports are linked to 1,000 times more deforestation than Brazilian chicken exports, although exports of soy for animal feed elsewhere remains linked to high levels of deforestation in Brazil.

The Yearbook finds that across different commodities, on average companies with voluntary zero-deforestation commitments are not yet performing better than those without, while the majority of exports of key commodities such as beef are still not covered by a commitment.

Helen Bellfield, lead editor of the Yearbook and Trase lead at Global Canopy, said, “In many countries the rate of agricultural deforestation has come down from the peak years of a decade ago. But the lack of progress in implementing zero-deforestation commitments and recent upticks in deforestation in some areas, including the Brazilian Amazon, underlines

how fragile these gains are. Companies and governments need to target implementation. Trase data provide a major step forward in our ability to assess the effectiveness of implementation efforts.”

Notes to editors

- The Trase Yearbook 2020 will be launched on 2 July 2020, but you can access its executive summary here. Trase team is also organizing a webinar on 2 July 2020, at 2 p.m. British Summer Time (BST), to present the main findings and discuss them with guest speakers, such as Francis Seymour (WRI) and Nicole Polsterer (Fern). The event is part of the London Climate Action Week.

- Trase is a science-based supply chain transparency initiative, built around an open-access information platform. Trase is a partnership between the Stockholm Environment Institute (SEI) and Global Canopy. It uses a unique approach to mapping agricultural supply chains that combines customs, shipping, tax, logistics and other data to connect regions of production, via trading companies to countries of import. Further details at www.trase.earth

- The Trase Yearbook 2020 provides an assessment of the state of forest-risk supply chains, based on Trase data and findings for each of the main export commodities it covers to date (Brazilian soy, beef and chicken; Argentinian soy; Paraguayan soy and beef; and Indonesian palm oil).