Forests cover almost a third of the Earth’s land surface (over 4 billion hectares), but the area is shrinking. Between 1990 and 2020, 420 million ha of forest was lost through deforestation. Although the rate of deforestation is declining, 10 million ha of forest per year was lost in 2015–2020. Loss of primary tropical forest is linked to climate change, biodiversity decline and human right abuses.

Financial institutions are exposed to deforestation risks through investments, services or loans to companies that produce or use agricultural commodities, such as beef and soy from Brazil, or palm oil from Indonesia. In 2021, banks and investors with inadequate policies on deforestation provided US$2.6 trillion to companies with the highest exposure to deforestation risk.

Deforestation and other nature-based risks are receiving unprecedented attention by financial institutions. For example, the Finance Sector Deforestation Action initiative, a group of over 35 financial institutions managing some US$9 trillion in assets, has committed to deforestation-free portfolios by 2025.

To support these efforts, a Taskforce on Nature Related Financial Disclosure (TNFD) was established in 2021 to develop a risk management and disclosure framework for companies and financial institutions. With widespread and growing support, this will provide impetus for financial institutions to develop due diligence processes to manage exposure to deforestation.

Regulatory pressures on companies to curb deforestation are increasing. In December, the EU agreed a regulation which will require companies to conduct due diligence on commodity imports to ensure they are deforestation free. A planned revision may extend the rules to financial institutions. Similar deforestation regulations are also being developed in the UK and in the US.

Getting to grips with deforestation risk

Mandatory financial due diligence already exists for risks such as money laundering, terrorism financing or corruption. Due diligence is increasingly being conducted on a voluntary basis to cover environmental, social and governance (ESG) issues such as financing fossil fuels.

There is a range of asset classes and financial services where extending due diligence to deforestation is relevant. Equity investments, bond issues, corporate lending and the provision of corporate finance services, are all financing activities where due diligence is key. Checks on bank lending and ‘sell side’ investment banking services such as bookrunning and underwriting are important as these represent significant financial flows into commodity markets.

Screening activity by asset managers is another area where due diligence processes can be brought in to address deforestation risk; for example, when reviewing potential candidates for inclusion in a portfolio. Deforestation due diligence should also be an important part of post-financing monitoring and engagement of portfolio companies.

Using appropriate data and tools not only supports due diligence of investments (buy side), but also deal origination (sell side) due diligence. This is important because many producers and traders are private rather than listed companies. Private companies need to raise finance from capital markets, so will need corporate finance advisory services, for example, when issuing a bond.

Data to inform financial decision making

Good quality data is fundamental to identifying and quantifying a financial institution’s exposure to deforestation risk, including related human rights abuses and land rights issues.

The two main areas that need to be addressed are direct deforestation exposure to individual commodity producers and traders, including subsidiaries and joint ventures; and indirect deforestation exposure via holdings, corporate finance services and lending to third parties.

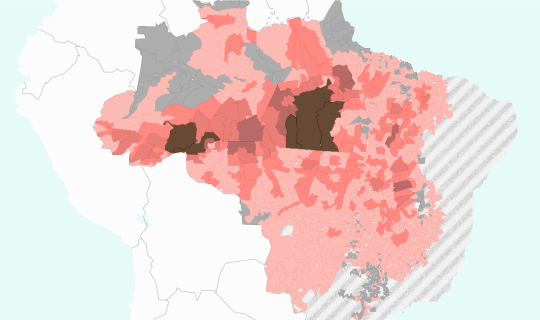

Data on deforestation exposure can be used to rate how risky a commodity trader’s supply chain is, direct attention to operations that should be scrutinised and inform an engagement strategy. More granular data enables banks and investors to focus on high-risk companies, assets and localities. For example, data can be used to link commodity supply chains down to the sub-national level by mapping the location of physical assets, such as slaughterhouses, connecting them to supply chains through traceability reports or tax data. In this way, location-specific deforestation impacts in the supply sheds of physical assets can be assessed and connected to the deforestation exposure of a trader’s supply chain.

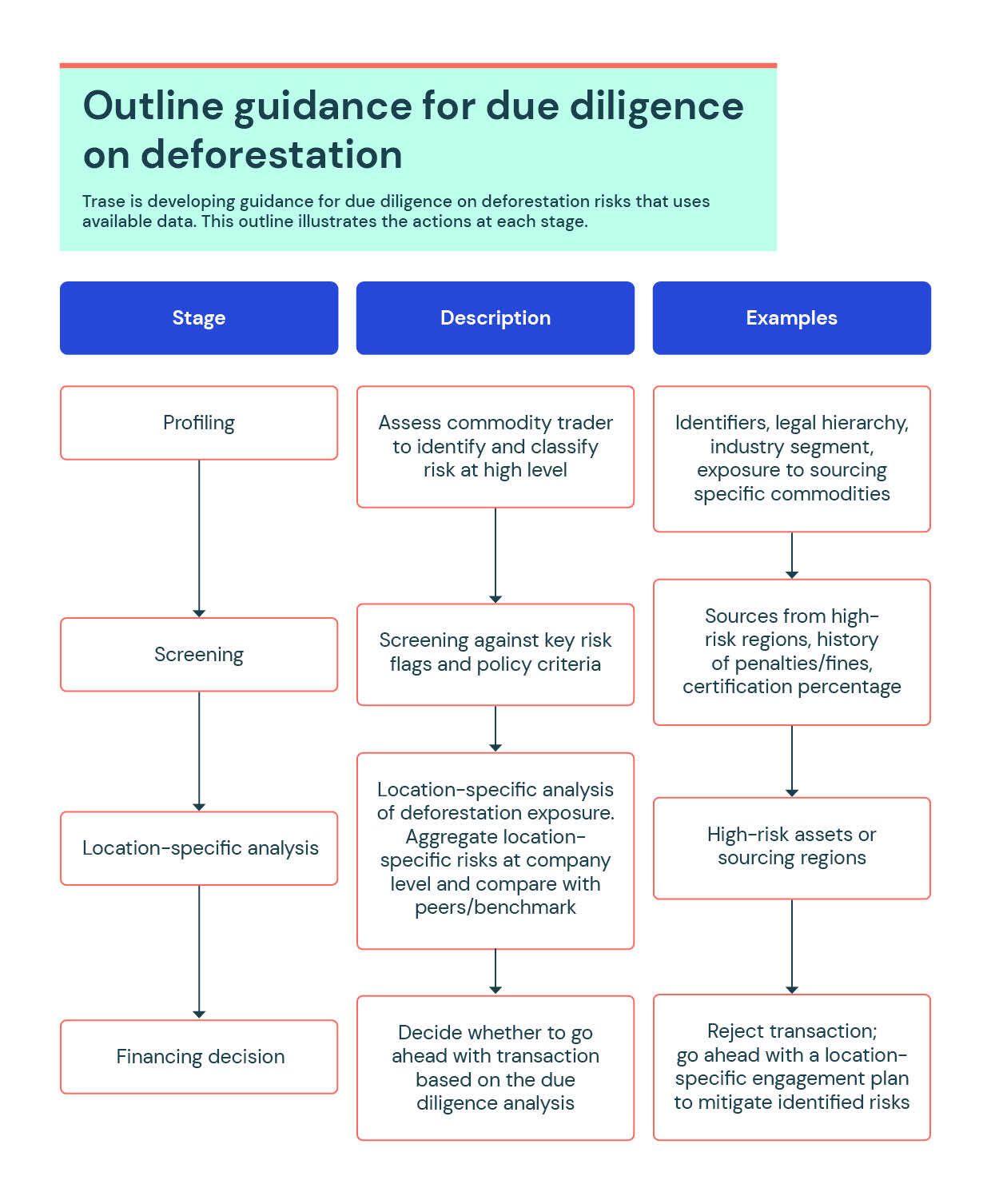

Given that most due diligence processes focus on risk, data should support a decision-tree process where ‘risk flags’ could potentially be raised at each stage. These indicate where a financial institution needs to conduct further investigation. Flags can be assigned for a range of factors, including sourcing of higher risk commodities and regions, opaque ownership structures, and lack of zero-deforestation commitments (see figure).

Financial institutions are in a strong position to use their leverage with companies to redirect finance away from activities that are driving deforestation, reducing their own exposure to risk. Data and tools to enable due diligence for deforestation are rapidly developing to support growing demand from financial institutions.

To find out more about Trase’s approach to due diligence for deforestation, contact Josh Brewer, Sustainable Finance Associate, j.brewer@globalcanopy.org

Was this article useful?