US FOREST Act: Lack of progress leaves forests at risk

US imports of commodities such as palm oil and cattle products could be driving large amounts of tropical deforestation, Trase analysis shows. Swift progress on proposed due diligence legislation could help – but there are still blind spots.

A bill to prevent US imports of products linked to illegal deforestation was reintroduced to Congress in November 2023, after an earlier version failed to get sufficient backing. But while the FOREST Act legislation slowly progresses, the US continues to drive demand for products produced on deforested land.

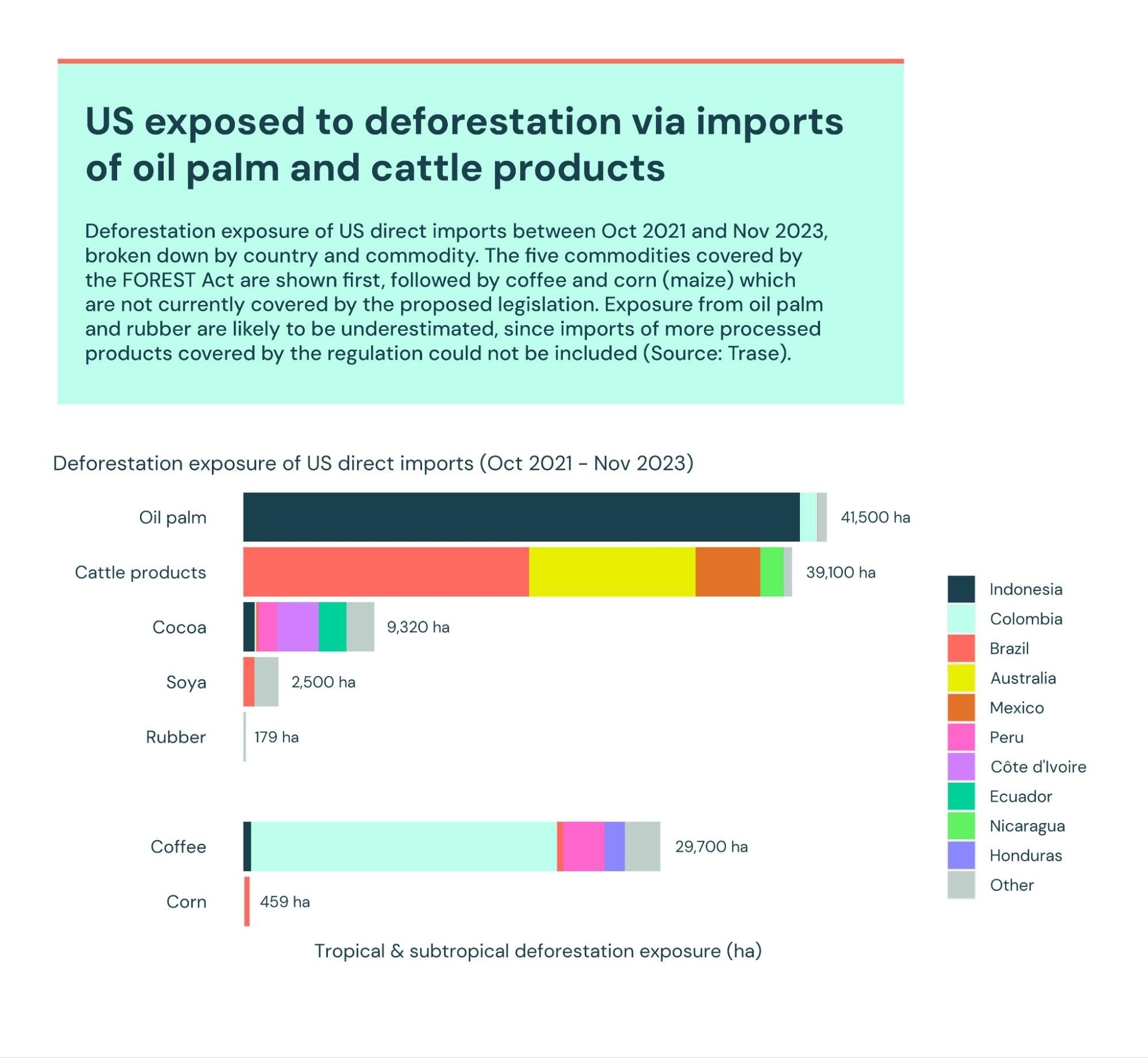

Trase analysis commissioned by Global Witness shows that between October 2021 and November 2023, the time between the bill’s first introduction and its reintroduction, the US’ direct imports of seven commodities exposed it to 123,000 hectares of deforestation in tropical and subtropical countries. This is an area similar in size to the sprawling city of Los Angeles, showing how swift approval of the Act could help reduce the impacts of US consumption on the world’s forests.

The biggest sources of deforestation exposure were palm oil (34% of the total), particularly from Indonesia, and cattle products (32%), particularly from Brazil and Australia. Other commodities covered by the Act are cocoa products (8%), which particularly expose the US to deforestation in Côte d’Ivoire, Ecuador and Peru, as well as soya and rubber products.

The analysis also showed that the US was exposed to significant deforestation from coffee imports (24% of the total exposure), especially from Colombia, Peru and Honduras. Coffee is not covered by the legislation, and these results suggest that this could be an important blind spot.

What’s in the FOREST Act?

Under the Act, imports of palm oil, soya, cattle products, cocoa and rubber would be banned unless importers can certify that they were not sourced from illegally cleared land. For high-risk countries deemed to need an ‘action plan’, this would require importers to provide supply chain information and the point of origin of those products, as well as demonstrating steps taken to address any identified risks.

The bill also includes funding and technical assistance for countries to implement these deforestation action plans, as well as bolstering the US’ power to tackle deforestation-related corruption and financial crime.

What’s missing from the Act?

Although passing the bill already presents a political challenge, environmental groups have expressed concern that it still does not go far enough. As well as missing potentially important commodities like coffee, the Act only relates to illegal deforestation: deforestation that violates laws in the producer country. This differs from incoming EU legislation that applies to all deforestation, legal or not.

This illegality requirement overlooks substantial amounts of deforestation that takes place in compliance with local laws, but which still pushes species closer to extinction, and is still a major source of greenhouse gas emissions. It also makes the Act’s intended outcomes susceptible to changing laws in other countries, and is likely to make its enforcement tricky, particularly for imports from countries where information on law violation is difficult to obtain, and where local law enforcement is weak.

Furthermore, although the bill goes beyond a strict forest definition to include ‘other wooded land’ (which would help it to cover much of Brazil’s biodiverse Cerrado savanna, for example), legal protections in non-forest habitats are often weaker, leaving them more vulnerable under a condition of illegality.

Another significant omission is the finance sector. Even if the US tackles its imports of forest-risk commodities, Wall Street would still be facilitating forest loss via its financing of companies linked to deforestation. Both the EU and UK are considering regulation to require financial institutions, not just importers, to conduct due diligence on their links to deforestation. If the US followed suit, it could help catalyse global progress.

What’s next?

Despite some bipartisan support, backing from environmental groups, and endorsement from the US cattle sector concerned about Brazilian competition, the 2021 bill failed to get the necessary backing to advance through Congress. It remains to be seen whether the revised and reintroduced bill will fare better, but recent support from some of the world’s largest food companies, including Nestlé, Unilever and Mars, may help.

Although there are clear opportunities to strengthen the bill, these must be balanced with political reality in the US. An expansion of scope to cover all deforestation is unlikely to be popular with American legislators. Sixty-six representatives from both the Democratic and Republican parties recently expressed concerns about the EU regulation’s “burdensome” impacts on US traders. Furthermore, widely-supported state-level legislation to tackle deforestation linked to imported goods in California and New York was vetoed by state Governors, chiefly over concerns about impacts to small businesses.

Rates of tropical forest loss continue to rise, despite international commitments intended to ensure the opposite. While demand-side regulations are no silver bullet, without suitable due diligence legislation, US supply chains will continue to drive further deforestation. Trase data underscores the urgency of the problem and shows the countries and commodities where swift approval of the FOREST Act could have the most impact.

Titley, M., & West, C. (2024). Deforestation exposure of US direct imports from October 2021 to November 2023. Trase. https://doi.org/10.48650/GTCN-KB62