How Brazil and China can use data for a more sustainable cattle sector

Pasture for grazing cattle is impacting natural ecosystems, with Brazil's 2020 beef exports linked to 340 million tonnes of emissions through deforestation. China is the largest importer of Brazilian beef and is therefore also the largest importing market exposed to cattle deforestation and conversion from Brazil. Here's how leveraging data and using monitoring solutions can help countries like Brazil and China to build a more sustainable cattle supply chain.

In Brazil, pasture for grazing cattle is swallowing natural ecosystems at an increasing pace, at grave cost to biodiversity and the climate. Beef exports in 2020 were linked to 340 million tonnes of the country’s greenhouse gas emissions through deforestation in the previous five years – equivalent to 37% of Brazil’s 2020 land use change emissions.

These concerns are of particular relevance for China as the largest importer of Brazilian beef and, therefore, the largest importing market exposed to cattle deforestation and conversion from Brazil.

Reassuringly, however, the barriers to action are falling and recent developments point to several strategic opportunities for these two countries to cooperate effectively on greening the beef and cattle supply chain.

Using improved data to target cattle deforestation

In the past, companies and governments were paralyzed by the complexity of supply chains – not knowing where they source from or even where to start looking. Now, new supply chain data from science-based initiative Trase reveals the value of targeting specific regions when developing solutions.

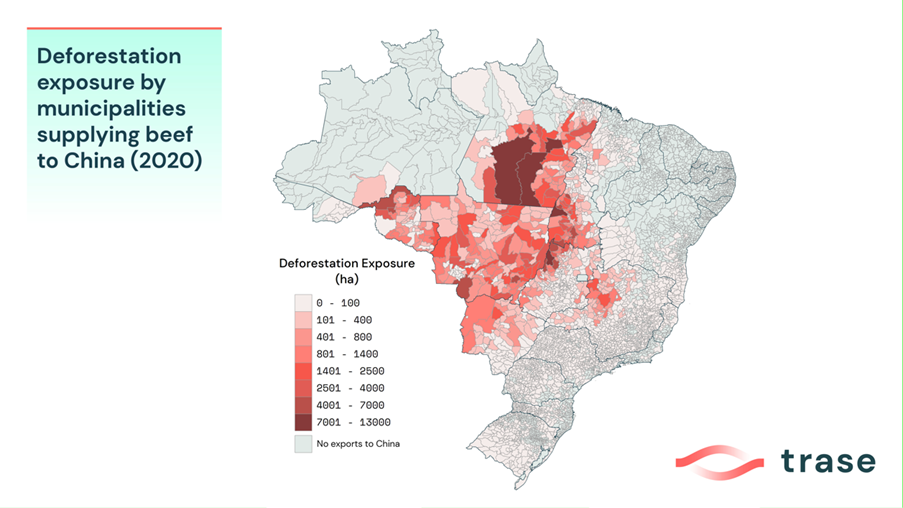

Cattle deforestation is highly concentrated in specific locations. About 2,900 Brazilian municipalities supply beef to China, but just 110 – fewer than 4% – together account for 70% of the total cattle deforestation linked to those exports.

Drawing on this finding, sustainability efforts within Brazil, such as capacity building and investments to support farmers to expand without deforesting new areas, can focus on where they can make the most difference.

For importers, the data can better inform not only trading decisions to target engagement with suppliers, but also the formation of relevant sustainable trade agreements and guidelines.

Shifts in trading patterns also put China in a good position to strengthen the application of environmental standards to beef imports. In 2010, 90% of beef from Brazil reached the Chinese mainland via Hong Kong, making it more difficult for Chinese authorities and stakeholders to understand the origins as well as the impact of the trade.

Over the last decade, however, the Chinese government has licensed dozens of slaughterhouses in Brazil for export to the Chinese mainland. In 2020, more than 75% of beef coming from Brazil was shipped direct to the mainland. This provides a stronger footing for incorporating land use sustainability standards into these supply chains.

Internationally, industry groups are increasingly turning to data-driven methods to implement aligned approaches to deforestation- and conversion-free (DCF) sourcing.

For instance, the Consumer Goods Forum Forest Positive Coalition (CGF-FPC) is developing a methodology for classifying soy origins by risk levels, based on data on the location and concentration of deforestation linked to soy cultivation, while the French Ministry for Ecological Transition has also offered companies a risk assessment dashboard, developed by Trase.

These guidelines and tools support companies in implementing and reporting on their deforestation-free commitments.

Monitoring systems enable tracking across supply chain

With quality tracing and monitoring frameworks, stakeholders can closely follow the movement of food products through all steps in the supply chain and thus address any links to deforestation.

There are already initiatives in place in Brazil to support and accelerate the implementation of the commitments made by the beef chain. These include Beef on Track initiative and Para State’s newly announced Cattle Integrity and Development Program.

To fully unleash the benefits of monitoring, it is crucial to build cooperation between Chinese buyers and the slaughterhouses that implement these monitoring systems.

Moreover, as the sector ramps up traceability efforts to meet the disclosure requirements of the EU’s deforestation regulation, this will lower the barriers for importers in China and elsewhere to access similar information.

Transforming collaboration on tackling cattle deforestation

Advances in sourcing practices offer experience and inspiration. In November 2023, Chinese trader COFCO International, which exports soy from Brazil, and Modern Farming Group, that produces milk products in China, signed a US$30 million purchase order for soy from Brazil, which incorporated a deforestation- and conversion-free sourcing clause for the first time.

This was recently followed by a memorandum of understanding for the supply of DCF soybeans to Sheng Mu Organic Dairy.

Chinese beef importers can draw on these experiences of collaboration between Chinese buyers and Brazilian suppliers to inform their own development, monitoring and review of sourcing requirements.

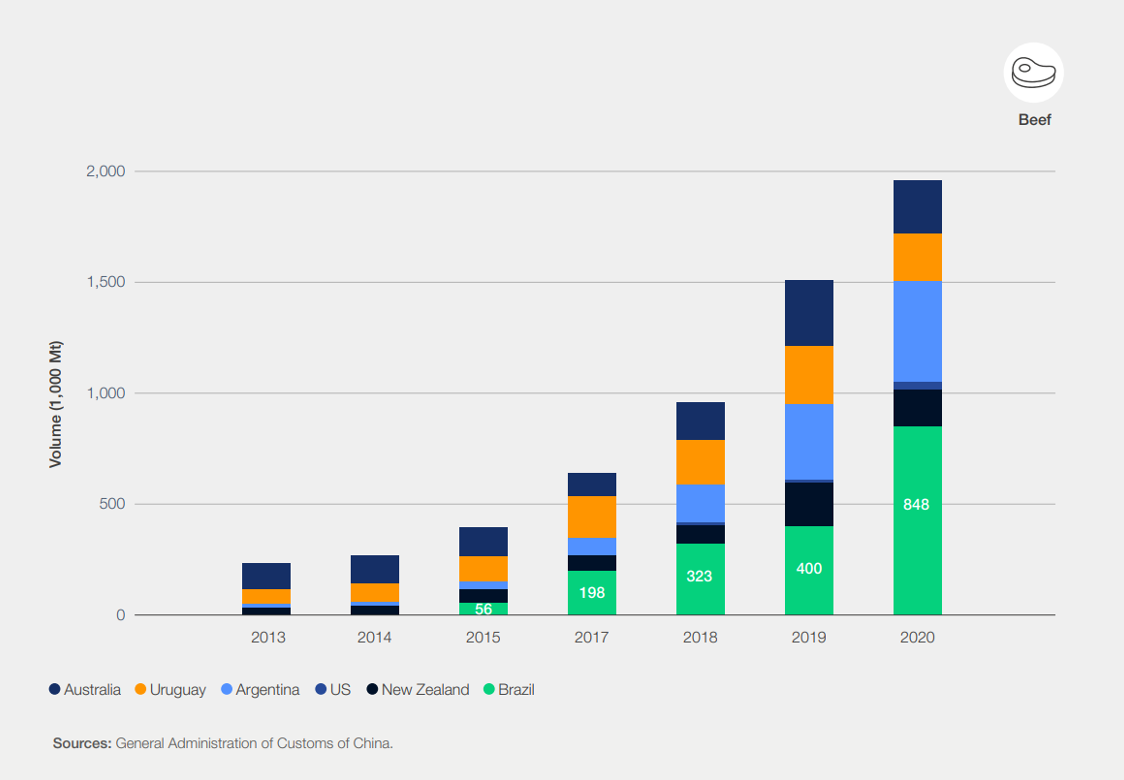

Joint efforts between China and Brazil have the potential to transform the entire sector. Although more than 70% of the beef produced in Brazil is consumed domestically, in recent years a growing proportion has been exported to China, with the volume of this trade quadrupling between 2010 and 2020.

China’s main beef suppliers, 2013-2020 Image: World Economic Forum's 'Green Value Chains for Soft Commodities: Quantifying the Chinese Market Opportunity' report

Across the sector, beef exporters are increasingly pivoting towards Chinese buyers. Strengthening strategic collaboration across these supply chains could galvanize change across the whole market, especially if it is supported by inter-governmental collaboration on policies and frameworks.

Data shortages, complexity of supply chains and business inaction have been cited in the past as barriers to effective action on deforestation.

The good news is that a wealth of guidance, frameworks and monitoring solutions has emerged in recent years, laying a firm foundation for China and Brazil to deepen cooperation for a more sustainable cattle supply chain.

This article was originally published by the World Economic Forum.